Donald Hay

Emeritus Fellow, Jesus College, University of Oxford

Disciplinary Brief

The call for climate justice has come from many environmental campaigners in recent months, not least from the lips of Greta Thunberg and her young followers. It is less evident in the vocabulary of environmental economists, but a type of ‘justice’ is implicit in the analysis that economists present and the policy solutions that they propose. This disciplinary brief, responding to Wolterstorff’s theological brief on Justice, will look for critical engagement between the analysis of justice that he has presented, and that of mainstream environmental economics.

To set it in context, we must briefly review the main scientific and economic elements of the problem (see Hepburn 2019 and Perman et al. 2011) [ 1 ]. We will not here make the distinction sometimes made between ‘global warming’ and ‘climate change’. The former frames the problem in terms of rising average global temperature and the latter frames the problem in terms of increasingly frequent extreme weather events, as a result of the warming. The former is more basic scientifically since warming implies extreme events, but the latter gives a more readily defensible basis for action using an insurance argument (outlined below).

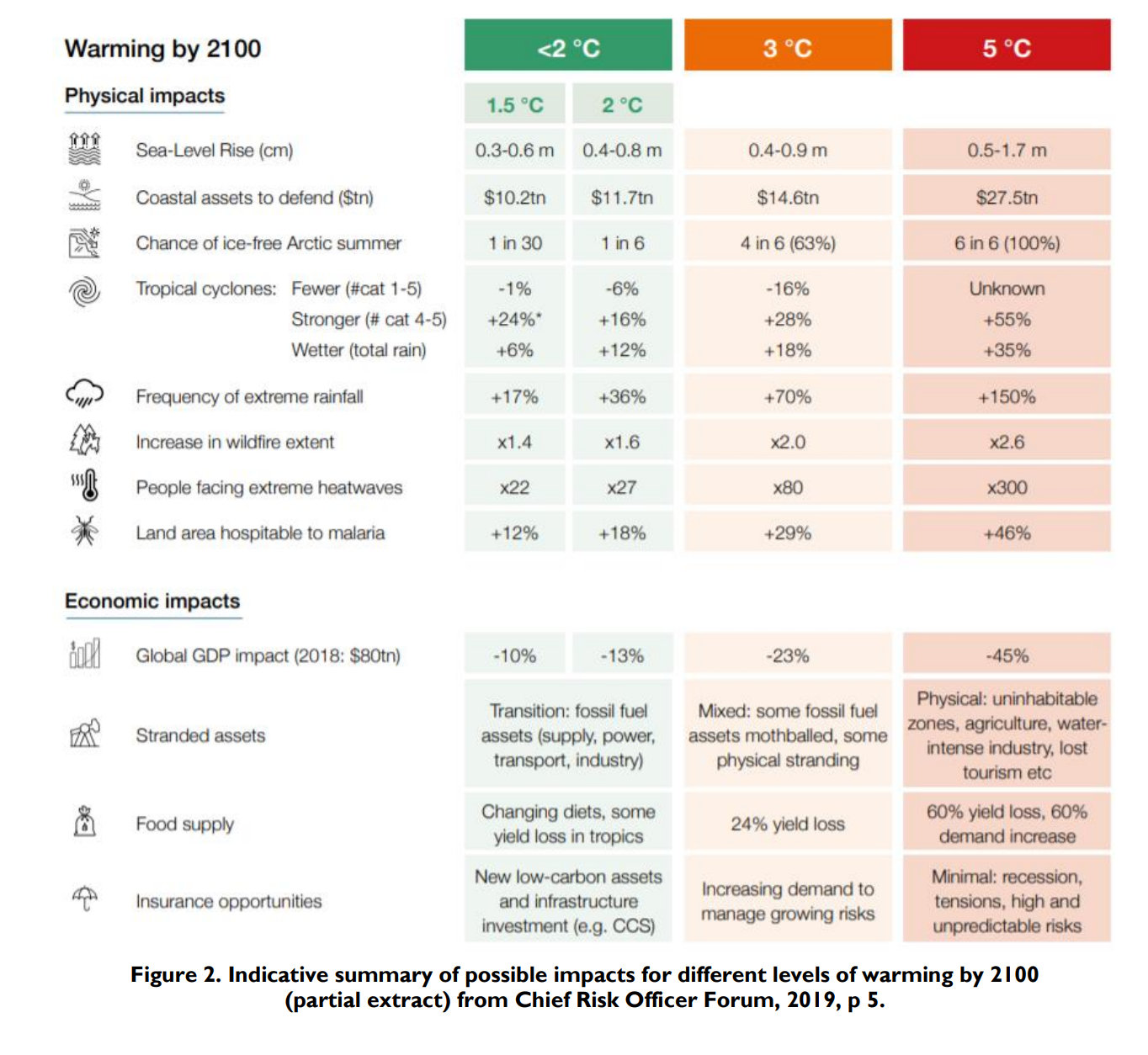

First, climate change is a good example of an economic ‘externality’, that is an economic consequence of decisions by a consumer or a producer of goods and services that is not accounted for in markets and therefore is not taken into account by the consumer or producer. If the consumer or producer uses energy derived from a fossil fuel, the result is an emission of CO2 or some other other greenhouse gas (such as methane NH4). Emissions add to the stock of greenhouse gases in the atmosphere. The effects of multiple private decisions on the stock, when compounded, have devastating effects, generating costs for everyone. The following table, from Hepburn (2019, pg. 4) outlines some of the more salient ones. It should be very evident that these effects have deeply troubling moral consequences in their effects on human flourishing.

Second, implicit in financial markets is a discounting of future events, whether good or bad. Thus a cost of $100 arising in 50 years from now, only has a current cost of approximately $23 if, for example, the interest rate is 3%. To put it succinctly, in conventional economic theory, economic actors, if motivated solely by economic rationality, should not be too bothered about costs that will be incurred by their grandchildren and great grandchildren. (This is not, unsurprisingly, a judgement with which we personally concur.) And, of course, their grandchildren may not yet be born, so they are unable to express any preferences about the future state of the world in current markets.

Third, a key feature of markets is the anonymity of those involved in economic activity. Even if a future cost is fully identified and evaluated, markets do not distinguish between the impact on a rich person and on a poor person. A rise in sea level due to global warming may flood both the Mar el Lago estate in Florida and a small inhabited island in the Pacific. In the former case, it might be thought that the owner can take the financial hit, but it will be utterly catastrophic for the islanders as it will destroy their homes and livelihoods. These cannot be morally equivalent.

An insurance framework reinforces this moral point. Action on global warming can be justified even in the face of high uncertainty of future impacts. Suppose in extremis that the spectre of warming and adverse weather events in the table above had only had a 50% probability (virtually all scientists would regard this as implausibly low). Even in this case, the damages associated with these scenarios would justify paying for some insurance in the form of slowing or halting warming. When the problem is framed this way policy actions being considered and implemented by the governments of the world take on the characteristics of a moral imperative common to all forms of insurance. That is, insurance is a blessing for the under-resourced and marginalized. The well-off, such as our proverbial residents of the Mar el Lago, can insure themselves by, say, buying a property elsewhere. The islanders cannot, and instead face not only financial devastation but also the extinguishment of their culture.

What implications for economic policy follow from these three elements? The standard economic prescription to deal with externalities is to ensure that they are priced, so that decisions taken by households and firms take them into account. In the case of climate change arising from CO2 emissions, the proposed price is either a tax on carbon that reflects the costs fully, or the requirement to purchase a ‘right to pollute’ permit from another party.

The ruling authorities are responsible for adjusting the tax rates, or the scale of the market for permits, to arrive at a sensible level of emissions. This in turn depends on the costs to society of ongoing emissions. Yet estimating these costs is a formidable challenge.

Evaluate costs First, we need to evaluate the economic costs of the consequences of global warming listed above. Recall that many of these costs will be incurred in the future, maybe not before the end of this century. Moreover, the likely changes in technologies between now and then have to be considered somehow: the world is unlikely to sit back and watch the unfolding catastrophe without trying to do something about it. But we have no means of knowing what technologies may emerge. In assessing the economic impact we should also take account of where those costs fall: as noted in the previous paragraph, it might be right to weight the costs for poorer people more highly than those for rich people.

Fixing a discount rate Second, we need to specify an appropriate discount rate to convert future costs into current values. As noted above, the choice of discount rate has a major consequence for current values, so identifying the right value is critically important. Using current market interest rates is unlikely to be a good choice, as those rates are often manipulated by central banks as part of economic policies to stabilise the economy in the short run. Economists tend to go back to first principles in deriving a rate. They note three elements:

the phenomenon of pure time preference: people prefer ‘jam today to jam tomorrow’. Quite why that should be is much discussed, but if it is a human trait it would be hard to dismiss.

it cannot be assumed that the world as we know it will still be here at the end of the 21st Century [ 2 ]. The threats do not arise exclusively from global warming: the list of hazards includes pandemics, pollution, nuclear catastrophe, an asteroid strike (like the one that did it for the dinosaurs), sunspot activity, and conventional warfare that disrupts agriculture on a world scale. It therefore may be appropriate to discount future costs and benefits (the technical term is ‘hazard rate’).

it is noted that the experience of economies, at least in the modern era, is that incomes rise over time: the assumption is that future generations will be richer than us, and so we should be less concerned about future costs – they will be better able to bear those costs.

There is no consensus on what discount rate should emerge from these elements: the Stern Review came up with 2.2% pa, but was criticised for being too kind to future (wealthier?) generations. Other economists dismiss all this as ‘back of the envelope’ calculations, and argue for the use of market discount rates, which tend to rather higher, implicitly discounting the costs to be incurred by future generations.

One other aspect of these economic calculations is worth considering. The predictions of climate scientists are subject, not surprisingly given the complexity of the modelling, to uncertainty, expressed in the reports of the IPCC as ranges of outcomes. The question for economic analysis is how to incorporate this uncertainty in policy responses. The insight from the insurance framework suggests we should pay particular attention to extreme outcomes even if their probability is low. For example, it might be appropriate to make investments in sea defences that would guard against rises in sea level that exceed the predicted average rise. This investment in mitigation would of course be more expensive than measures to counter the average.

All this granted, many areas of government policy are subject to formidable information challenges, so there is no special problem posed by climate change. For example, think of the longstanding impacts of educational reform, and the unfathomable intergenerational consequences. Uncertainty about the future is ubiquitous, but policy makers should not let what they don’t know distract them from what they do know. In this context, a key contribution of economics, rarely understood, is that whilst our discipline is powerless to arrive at a global prescription for emission reductions, the allocation of where those emission reductions should occur (which individual or firm should abate their emissions) is, in principle, solvable.

The solution? Establish a common price for emissions like CO2 either through taxes or tradeable permits. Without going into laborious technical detail, rationing pollution, or any other good, by price is often more beneficial than rationing by rules-based fiat. For example, consider two policies to halve vehicle emissions, which are known to contribute to global warming. In the first policy, all vehicles are subject to a rule that they can only be driven on odd or even calendar days, and must maintain their current mileage. Such a policy would approximately halve emissions, but the attenuation of police or ambulance numbers would be unwelcome, and even morally reprehensible. In the second policy, a price on emissions (a tax or a purchased permit) is raised sufficiently high to halve emissions. It is this scenario, and not the calendar policy, which is likely to see high value uses of fossil fuels – such as ambulance miles - preserved while low value uses – such as careless multiple trips to the supermarket – abandoned. Economists call the ‘least cost abatement’ or ‘efficient abatement’.

What concept of justice is implicit in the approach of environmental economists? The underlying utilitarian presumption is that the costs of climate change should be assigned across generations: if, ceteris paribus, a particular economic activity will bring equal benefits to current and future generations, then the ‘pain’ should be shared between them [ 3 ]. Note however this is a judgement that has to be made by the current generation, since future generations are not present to exercise their voice. It is far from evident that the evaluation of future generations will be the same as that of their predecessors: they have been deprived of their right to express their preferences. [ 4 ]

What ‘rights’ might we assign to future generations, to relate this discussion to Wolterstorff’s treatment of rights as fundamental to justice. He puts it like this: ‘All instances of first-order justice are cases of an agent rendering to another what is their right or due: all instances of first-order injustice are cases of an agent not rendering to another their right or due’. In his analysis of climate change, Caney (2006) appeals to the 1972 Stockholm Declaration of the UN Conference on Human Environment: ‘Man has the fundamental right to freedom, equality and adequate conditions of life, in an environment that permits a life of dignity and wellbeing, and he bears a solemn responsibility to protect and improve the environment for present and future generations.’ If this is correct then the present generation has to render to future generations an environment that is not despoiled or irreversibly degraded. Note that discounting the future does not come into the analysis of this right and our obligation. There is no good reason for diminishing the rights of future generations just because they happen to have been born after us.

In the discussion above it was also claimed that pricing ‘rights to pollute’ through permits or taxes was a good way of deciding which units (individuals or businesses) would be the ones to reduce emissions. In this context we might comment that although rationing through price allows the continuance of many worthwhile activities, it is a crude solution. The problem is that some units (individuals or businesses) may not have the resources to pay for worthwhile emissions, so their ‘right to pollute’ cannot be exercised. This is an example of a more general problem of using prices and markets to allocate goods: an appropriate solution may be to transfer resources to those who are relatively poor.

The discussion so far has assumed an anthropocentric understanding of the moral implications of climate change. But that is only a part of the Christian understanding. No doubt humankind is given the created order to provide for human flourishing. But humankind is also enjoined (in the Genesis account) to exercise covenantal responsibility. It is God’s creation, which he sees as ‘very good’; we have no right to possess it for ourselves but rather the responsibility to steward it carefully. The language of dominion (‘rule over’) is used in the OT of the responsibility of kingship, and the ideal of kingship is that of the shepherd, who has a particular concern for the poor and disadvantaged.

To conclude, economic analysis works with a thin doctrine of the ‘rights’ of future generations. Their interests are confined to their consumption of goods and services, and even those are given lower weights because of discounting. It is morally indefensible to allow ourselves greater consumption now, and to transfer the environmental costs and consequences to our children and grandchildren who have no voice. They have as much right as we do to a world that is not irretrievably damaged. And, to employ the insurance argument one last time, although it has been the historic experience of the last two centuries that forebears are poorer than their progeny, there is always a chance this will state of affairs will not continue – an eventuality which current generations can insure against by good stewardship and greenhouse gas abatement. Most importantly, God has commanded us to care for his created order, even as we are permitted to use it for human flourishing. We have no right to despoil it.

Our discussion would be incomplete if we did not address what Wolterstorff terms ‘second order justice’. Our focus so far has been on ‘first order justice’: agents (individuals, households, firms, institutions, authorities) treating others as their rights require. ‘Second order justice’ is what is needed to put right injustices that have been perpetrated when first order justice has been violated. This can involve a range of measures, but in the climate change context these might most naturally include compensation for costs inflicted on others, and action to reverse the environmental damage that has been caused.

Compensation for Costs. For example, much of the accumulation of CO2 in the atmosphere is historic, arising from the Industrial Revolution in Europe and later North America. The call from many poorer countries for financial assistance to deal with the consequences of climate change should be seen as putting right that historic injustice. Moreover, if pollution permits (rights to pollute) are traded internationally as part of the solution to global warming, the weakness of price-based rationing noted above – namely that some units (here, countries) are too poor to exercise a right to pollute – can be addressed through such financial transfers.

Action to Reverse. Perhaps the rich economies of the West should be required to invest heavily in carbon capture, not just to offset current emissions, but also to deal with the CO2 build up for which they were responsible. Reversing environmental damage is probably best addressed by programmes not only to preserve what remains from exploitation, but also to restore it. Deforestation is a global problem. For example, we not only need to stop destruction of tropical rain forests, but also need projects to replant wherever this is feasible. The same imperative should inform tree planting programmes around the globe. More speculatively we should perhaps think of second order justice in relation to God himself. If we have not been responsible in exercising our stewardship of his world, then Christians at least must consider what they might do to redress some of the damage they have caused in the past. Conservation and restoration should become a part of Christian discipleship, not just the calling of a few environmentally committed Christians.

Caney C. (2006), ‘Cosmopolitan justice, rights and global climate change’, Canadian Journal of Law and Jurisprudence, XIX, 255-278

Hepburn, C. (2019), Common Climate Questions and Answers, Smith School of Enterprise and the Environment, Oxford UK.

Perman, R., Ma, Y., Common, M., Maddison, D., and J. McGilvray,(2011), Natural Resource and Environmental Economics, 4th Edition, Pearson.

Raworth K. (2017), Doughnut Economics: Seven ways to think like a 21st century economist, Random House

Martin Rees (2003), Our Final Century: Will the Human Race Survive the Twenty-first Century?, William Heinemann, London

Stern N.H. (2007), The Economics of Climate Change: the Stern Review, Cambridge University Press

[ 1 ] We confine our discussion to mainstream economic analysis and policy. There are alternative frameworks which paint a very different picture: see for example the ‘doughnut economics’ of Raworth (2017).

[ 2 ] See Martin Rees (2003)

[ 3 ] This evaluation may be adjusted to give priority to alleviating impacts on those least able to bear them, following a Rawlsian requirement that we should attend first to the needs of the least well resourced.

[ 4 ] Note that this is an issue that arises more generally in intertemporal allocation: examples are the exploitation of non-renewable resources, and the dissipation of family wealth by one generation without thought for their children and grandchildren.

Download